Nuanced discussions around price and value are important to business success. It’s surprising therefore that most pricing deliberations quickly devolve into a simplistic lowest common dominator – price cutting. This occurs even when there’s no evidence that price is the primary concern for customers!

The way to overcome this is to understand what supports your price and what value means to your customers.

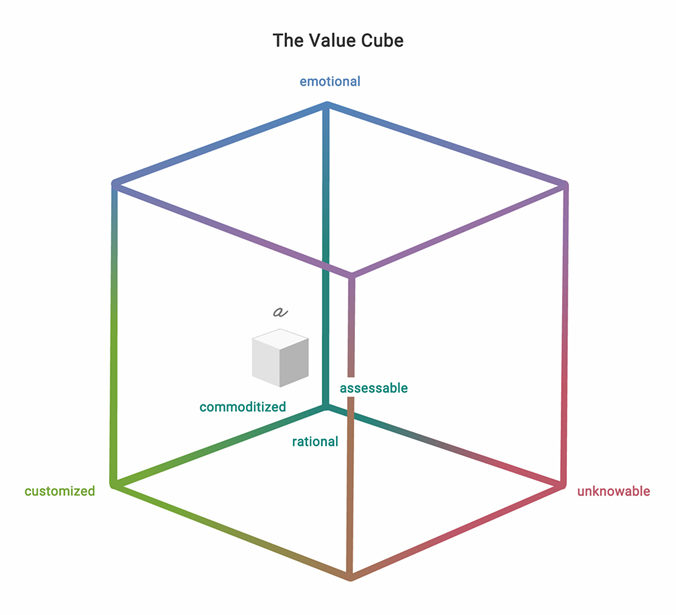

I’ve invented the Value Cube to help my clients visualize the issues and to nudge their pricing conversations along a more sophisticated path. The Value Cube forms the basis of an informed conversation about the price of products and services rather than relying on the “pin the tail on the donkey” approach all too many businesses take. Here I describe three applications by clients of this tool.

Dimensions of the Value Cube

The Value Cube (see diagram above) is structured around the answers to three fundamental questions.

What is the nature of the product or service? Is the product or service customized or commoditized? In other words, is the product or service made to a customer’s requirements (e.g., tailored men’s suits) or is it completely standardized (e.g., coking coal)? There’s more scope to play with prices for a customized product than there is with a commoditized product. So, the X axis of the cube runs from customized to commoditized.

What is the effect of the purchase on the customer? Is the purchase decision emotional or rational? This describes whether a product or service engages the buyer’s emotions (e.g., wedding planning) or whether it is evaluated on function alone (e.g., petrol/gas for cars). Consumers are inclined to be less cautious about price where emotions are entangled in the purchase. When your heart is set on something, the purse strings can loosen. The Y axis runs from rational to emotional.

Can the customer evaluate the results? Is the result, and the process to achieve it, assessable? In some cases, the customer can judge the effectiveness of a product or service on their own (e.g., a new kitchen). In other cases, the consumer must rely on the assurances of the provider (e.g. brain surgery). Consumers will pay more for services they find mysterious. The Z axis runs from assessable to unknowable.

The Value Cube generates eight extreme positions at the points of the Cube:

- Customized-emotional-unknowable

- Customized-rational-unknowable

- Customized-emotional-assessable

- Customized-rational-assessable

- Commoditized-emotional-unknowable

- Commoditized-rational-unknowable

- Commoditized-emotional-assessable

- Commoditized-rational-assessable

Let’s now look at three ways the Value Cube has propelled the pricing discussion.

Battling Hard to Stay on Brand

Paul heads a property valuation business I’ll call Ashtons. He’s also one of three partners in the firm, which assesses properties ranging from multi-story buildings and factories to apartments. The firm’s customers are banks and other financial institutions that require a valuation for loan purposes.

As part of a review, I presented the Value Cube to Paul and his management team. Paul was taken aback by the discussion which ensued. “We’ve drifted,” he concluded. “Without really noticing it, we’ve started to slide to position 8 – commoditized-rational-assessable. I now realize from our discussions using the Cube that in our desire to chase work we’ve started to cut price and commoditize our service.”

Paul explained that over the 30 years since the firm was established it has always tried to position itself at the high end of the industry. It had constructed its website and other materials accordingly. “We’ve let that slip,” he concluded. “We need to get back to where we belong – at 4 – customized-rational-assessable.”

Paul’s price-setting dance starts with client selection. “There’s a natural tendency in the property valuation industry to chase volume by lowering prices and pursuing any client.” However, Ashtons brand is built around a customized, quality service. “Sometimes, though, you need nerves of steel to tough it out,” says Paul.

“The Value Cube has stressed the importance of keeping Ashtons’ image and brand clear in clients’ minds as ‘top of the range.’ It really helps to have a visual tool to see where we sit.”

Sandwiched But Room to Move

Oliver is the recently appointed CEO of a company that makes concrete and clay roofing tiles for homes. I asked him where his business sits in the Value Cube. His response was swift. “We’re dealing with a commodity so the ‘customized’ positions 1 to 4 are out for us,” he said. “Our buyers are builders and distributors with about 50 percent of sales from each. The quality of our products can be evaluated. So, I think we’re at 8 – commoditized-rational-assessable.”

Looking at the Value Cube he commented: “We’re pretty much the same as our competitors but we try to edge things up on price.” His company has two competitors and work is won by a combination of tender (for builders of multiple homes), quotation (smaller jobs) and a schedule of prices.

Oliver then made this insightful observation. “I wonder if, once you’re seen as a ‘commodity,’ the ‘unknowable’ and ‘emotional’ positions in your list really exist? In other words, once your product or service becomes commoditized emotion and mystery disappear.”

The penny had dropped – the only way to provide increased value (and therefore justify increased prices) in Oliver’s commodity-based business was to move on the other axes of the Cube. Oliver declared, “While the company’s products are viewed as commodities, we can customize on service.”

He explained that “our best strategy is to work on making our service outstanding and a real differentiator.” This includes delivery on time and in full, resolving any customer issues quickly and happily, having constant contact with decision-makers, and providing technical advice where needed.

“Your Value Cube has helped reinforce the importance of that,” he concluded.

Constant Struggle

Leanne heads a team of sales staff whose job is to prepare campaign proposals for media companies. These companies buy on behalf of clients across four “channels” – TV, print, radio, and digital audio (radio delivered via the internet).

When I presented Leanne and her team with the Value Cube, they immediately recognized that their product was customized. She added “and being provided to media buyers it’s hardly emotional. So, we’re kind of a 4 (customized-rational-assessable) but not quite.”

The revelation was that her business wasn’t positioned at one of the eight extremes of the cube but rather “floating.” (See “a” in the Cube as an example.) “Our results are assessable but not completely. There are many unknowns and rating agencies can only give approximate results.” While third parties can track digital audio, she could only estimate the total listening audience by multiplying this to produce a total. “And that’s only ever approximate,” she added.

Discussion around the Value Cube has led Leanne and her team to better appreciate why the outcomes are always “rubbery.” It has also helped explain why she and her team must constantly focus on building rapport, uncovering information about their client’s customers, and designing a “response to brief” that demonstrates value for money. “We’re constantly having to explain to media buyers the benefits we provide,” she concluded with a sigh.

*********************************************

You may have had the experience that any discussions around price are quickly funneled down into a debate about how to make your product or service cheaper. This comes from a lack of understanding of what supports your price and what true value represents to the customer.

The best course of action is to draw back from this vortex and to think about how customers appreciate “value.” The Value Cube can be a useful tool in your pursuit of an appropriate price for your product or service – one that will put you in a better position to yield both a competitive advantage and the requisite profit for your business.